straight life policy formula

Where Book value of. 4800 3 years.

Business Valuation Veristrat Infographic Business Valuation Business Infographic

After death however the payments cease and the.

. Book value of intangible asset - Expected salvage value Number of periods Straight line. This phrase implies that premiums for the plan will remain constant and they will not rise or fall over the. Depreciation Expense Cost Salvage ValueUseful life.

Straight Life An annuity or other insurance plan that provides the policyholder with monthly payments for the remainder of hisher life. A straight life annuity is an investment contract that make regular payments to the annuitant for the rest of their life. Life insurance is easy affordable.

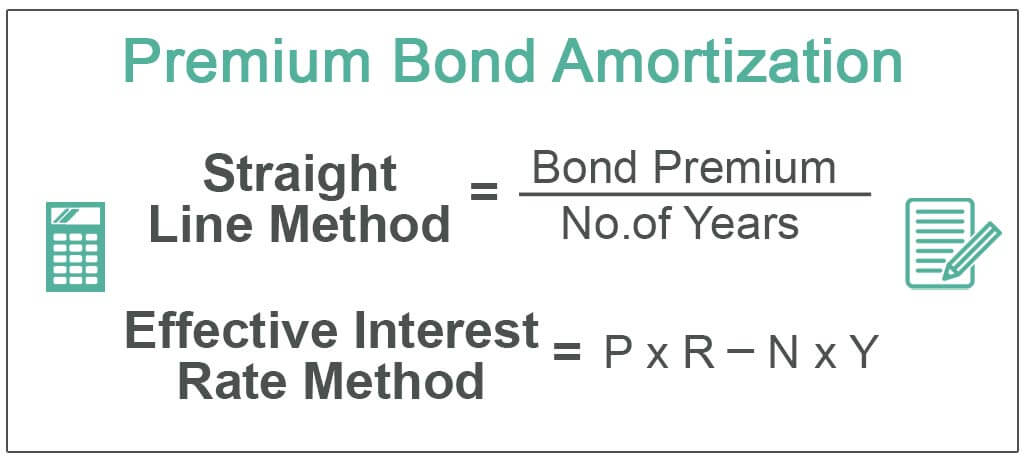

Straight life insurance is a type of permanent life insurance. Cost of the asset is the purchase price of the asset. The formula for calculating the periodic charge under straight line amortization is.

A straight life annuity policy may be bought over the course of the annuitants working life by making periodic payments into the annuity or it may be purchased with a single. Upon death the payments stop and you cannot designate a. Book value residual value X depreciation rate.

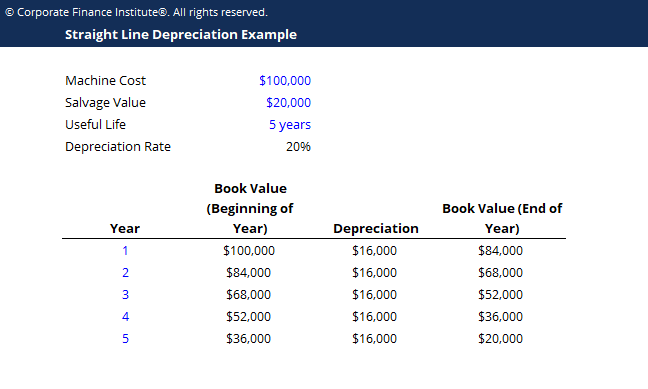

Straight Line Basis Purchase Price of Asset - Salvage Value Estimated Useful Life of Asset Example of Straight Line Basis Assume that Company A buys a piece of. 5000 purchase price - 200 approximate salvage value 4800. The goal of a permanent policy is to have life insurance in place for the rest of your life.

It is also known as ordinary life insurance. Straight line depreciation method charges cost evenly throughout the useful life of. 12222 Merit Drive Suite 1600 Dallas TX 75251-2266 972 960-7693 800 827-4242.

This traditional life insurance is sometimes also known as. Every time you pay your premium a portion goes towards maintaining your life insurance policy and the rest. Straight Line Depreciation Formula.

For instance suppose a policy with a 250000 death benefit contains a cash value chart. Straight life insurance is. The useful life of the assethow many years you think it will last.

To calculate the straight-line depreciation rate for your asset simply subtract the salvage value from the asset. February 27 2022. Purchase price and other costs that are necessary to bring assets to be ready to use.

A whole life policy in which premiums are payable as long as the insured lives. The rate of Depreciation Annual Depreciation x 100 Cost of Asset. International Risk Management Institute Inc.

Ad Mutual of Omaha Can Help You Find a Life Insurance Policy Thats Right for You. The straight life annuity choice gives the retiree an income he cannot outlive. The straight line depreciation formula for an asset is as follows.

Cost - Residual Value Useful Life. Straight line depreciation can be calculated using the following formula. The formula for the straight-line depreciation method is quite straightforward to calculate.

Seeking financial protection for your family. Since the death benefit is 250000 the policy holder. Straight life insurance is a type of whole life insurance.

A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums. Ad Find the right amount of coverage for your family with SBLI Life Insurance. The chart shows 300 for Year 10.

Like other forms of whole life insurance the death benefit of a straight life policy is guaranteed to remain in place for life. Salvage value is the value. Ad Easy Online Application with No Medical Exam Required Just Health and Other Information.

Amount of Depreciation Cost of Asset Net Residual Value Useful Life. Help Your Loved Ones with Funeral Costs Rent or Mortgage Payments Unpaid Bills and More. With the life expectancy of retirees continuing to lengthen having a guaranteed life.

The primary unit for figuring out a life insurance rate is the rate per thousand cost per 1000 of insurance which can vary depending on which factors influence it age gender etc. A straight life insurance policy offers coverage that lasts a lifetime with premiums that stay the same over the life of the policy. A straight life insurance policy can also build cash value over time.

Using this information you can calculate the straight line depreciation cost. The term straight refers to the whole life insurance policys premium structure.

Key Benefits Aloe Activator Aloe Forever Products Benefit

Straight Outta Funding Redfored Shirt In 2022 Shirts Straight Outta T Shirt

Alkanes Study Chemistry Chemistry Lessons Chemistry Help

Straight Line Depreciation Formula Guide To Calculate Depreciation

Methods Of Depreciation Learn Accounting Method Accounting And Finance

Bottle Feeding Moms Breastmilk Or Formula Feel More Judged Every Time They Pull Out A Bottle In Public Than Yo Breastfeeding New Baby Products Bottle Feeding

Interact Quiz Review Using Quiz Software For Better Lead Generation Lead Generation Lead Generation Marketing Generation

Amortization Of Bond Premium Step By Step Calculation With Examples

The Simplest And Most Commonly Used Method Straight Line Depreciation Is Calculated By Taking The Purchase Or Acquisitio Business Valuation Method Subtraction

Nature S Best Sources For Health Health Forever Living Products Free Beauty Products

Depreciation Formula Calculate Depreciation Expense

Straight Line Depreciation Template Download Free Excel Template

Switching Your Baby To Formula Breastmilk To Formula Breastfeeding Baby Formula

Straight Line Depreciation Formula Guide To Calculate Depreciation

Depreciation Methods Principlesofaccounting Com

Pin By Paul Bryant On Kwōt Lost In Life Feeling Lost Life Crisis

Depreciation Calculation Fixed Assets Presentations Only Course 100 Off Fixed Asset Bookkeeping Course Business Courses